Readers Submissions

The Man Who Distinguished Himself as the Vice-President in Hiding

Submitted on: January 18, 2026

Submitted by: anderson connell

The Man Who Distinguished Himself as the Vice-President in Hiding

By David L. Dec Bowen JP

Every political era produces its stand-out figures, the reformers, the fighters, the loyalists who stand firm when conditions worsen. And then there are those who perfect a different craft altogether. Michael Lashley distinguished himself not by leadership in adversity, but by disappearance when leadership mattered most.

The office of Vice-President of the Democratic Labour Party was never intended to be symbolic. It was meant to anchor the party in moments of pressure, to provide steadiness when electoral defeat, public criticism, and internal strain converged. Instead, when the party entered its most difficult period, the Vice-President perfected a quieter role, that of the Vice-President in Hiding.

While the Democratic Labour Party faced its harshest scrutiny in a generation, Barbadians searched in vain for his voice. There was no rallying call, no public defense of colleagues, no visible effort to shoulder responsibility. Silence was not accidental; it was consistent. When the party needed leadership from him, it got absence. When it needed courage, it got concealment.

This was not strategic restraint. It was political self-preservation and cowardice. Others stood in the line of fire, absorbed the blows of public anger, and carried the burden of defeat. The Vice-President, meanwhile, ensured that his record remained pristine, untouched by decision, unscarred by accountability, and safely removed from consequence.

Having retreated when the weather turned hostile, he has now conveniently re-emerged on the sunnier side of the political street, ascending into the ranks of the BLP. The journey tells its own story. Loyalty, it seems, was conditional. Principle was negotiable. Survival, however, was non-negotiable.

Barbadians should harbour no illusions that this change of jersey signals a change of character. The behaviour is entirely consistent. When times are hard, he disappears. When power is secure, he resurfaces. The same instinct that kept him silent in opposition will keep him silent in government, especially when difficult questions arise.

If politics is about service, then this record reflects something else entirely: office without burden, title without duty, and presence without responsibility. If leadership is measured by who stands when it is uncomfortable, then this tenure will be remembered for doing precisely the opposite.

In the end, history will judge many harshly for what they said and did. The Vice-President in Hiding will be judged for something far worse, that when leadership was demanded, he chose invisibility, and when accountability loomed, he chose alignment.

Political parties may change. Governments may change.

But the habit of hiding, once perfected, rarely disappears.

And Barbados should expect nothing more, and nothing less, than consistency.

David L. Dec Bowen JP

Celebrating Progress and Success

Submitted on: January 16, 2026

Submitted by: anderson connell

These days it is rear to attend a Celebratory event that gives total satisfaction for the event and its underlying cause). I was privileged to be invited to and attend such an event in honour of 25 years operation of Nailah House, owned and run by a very good friend Jennifer Lapompe.

Below, Jennifer gives us a little insight into the history of Nailah House, her passion for social care engagement, and the celebration of providing a residential care service to young people over the past 25 years.

25 Years of Impact. – 25 Years Walking in Purpose

Jennifer Lapompe

On Friday 9 January, Nailah House proudly celebrated 25 years of operation, marking a significant milestone in its journey of providing residential care, stability, and consistent support to children and young people.

Founded in January 2001 by Jennifer Lapompe, Nailah House Children’s Home provides care and accommodation for young people aged 13 to 18 years. Over the past quarter of a century, the Home has remained committed to offering a safe, nurturing, and purposeful environment for some of society’s most vulnerable children.

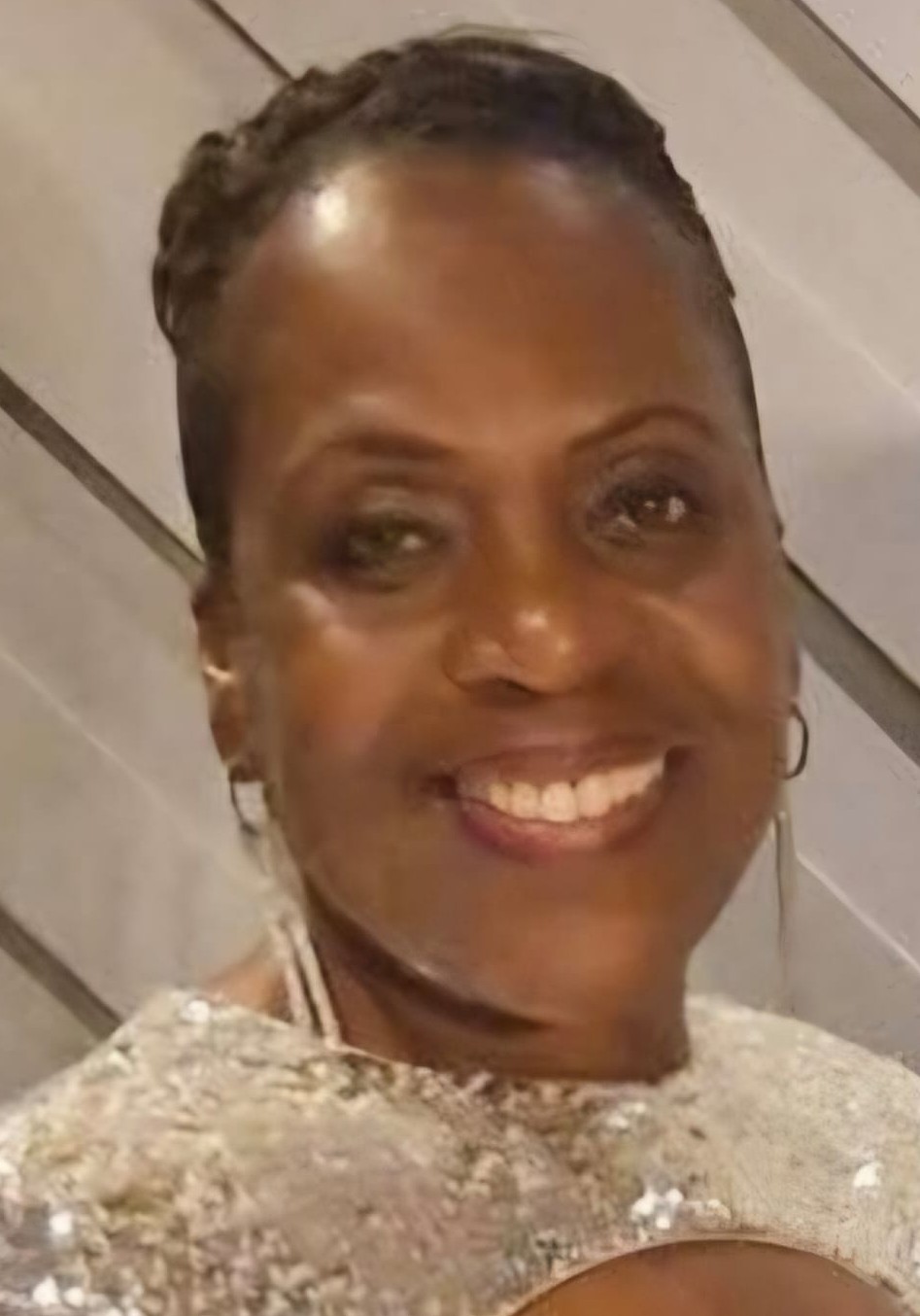

Founder Jennifer Lapompe is a Barbadian-born entrepreneur, author, social care provider, international speaker, award-winning humanitarian, and ordained Minister of the Gospel.

Jennifer founded her first company, JaNailah Ltd, in 1997, with a primary focus on preventative services, aimed at reducing children’s entry into the care system. Through JaNailah Ltd, Jennifer also delivered consultancy and training to individuals, organisations, and community groups.

Jennifer’s professional background spans over 40 years of leadership across public and private sectors. She is a qualified social worker, youth worker, community worker, manager, practice teacher, and trained coach, specialising in personal development and business mentoring. Her work has consistently focused on enabling individuals to uncover purpose, develop confidence, and achieve their best potential.

Jennifer’s shares that it was never her original intention to establish a children’s residential home. Having successfully developed a care Home for a London borough, she was inspired to create her own, rooted in her own values. In September 2000, Jennifer purchased a large property in east London and undertook extensive renovations to ensure the environment was safe, welcoming, and homely. By December 2000, the renovations were complete, and in January 2001, Nailah House officially opened its doors.

Reflecting on the realities of sustaining a children’s residential home over 25 years, Jennifer openly acknowledges the challenges of the sector. She describes residential care as one of the most demanding businesses to establish and maintain, requiring constant availability, emotional resilience, and unwavering commitment, particularly in the early years.

Emergencies are frequent, and responsibility is continuous. Jennifer highlights the impact of heavy regulations, including unannounced inspections by OFSTED, and the pressures this place on managers and frontline staff. She describes the care system as operating within a blame culture, making it essential for her to act as a buffer between regulators and her team. Central to Jennifer’s leadership philosophy is ensuring care, value, and protection of staff working on the frontline.

Jennifer purports that “oftentimes, those who care for society’s most vulnerable are the least valued or respected” in society.

Jennifer is currently writing a book reflecting on the realities of operating a care business, drawing on her lived experience, leadership insight, and long-term resilience within the sector.

Reflecting on the journey, Jennifer shared:

“When I reflect over 25 years, I am humbled by the young lives that have been positively impacted. This work has never just been a business to me—my purpose has always been one of service to others. Despite the challenges, the regulations, and the moments when it felt overwhelming, I know I am walking in my purpose. When I reached that realisation, my perspective changed.”

This reflection captures the heart of Nailah House: a service built not only on professional expertise and regulatory compliance, but on deep personal conviction, resilience, and service to others.

Jennifer shared that there has been more than one occasion where she was ready to walk away from the service, highlighting the emotional, physical, and personal toll of sustaining a residential care service. However, purpose, faith, and commitment to young people sustained the journey. There was a moment where she prayed to be released, but felt a tug from God, urging her to continue. Jennifer shared that the realisation that the children’s Home was part of her ‘ministry’, was a pivoting point for her.

Jennifer’s entrepreneurial endeavours doesn’t stop here. Her second company, Essence of Ilia, operates as a transformation-based enterprise showcasing her writing, faith-based products, seminars, and her most recent “Heb Seven” clothing line.

Ordained as a Minister of the Gospel in 2009, Jennifer is licensed to minister globally. In 2010, she founded the registered charity Shai Foundation, which she describes as her ‘ministry’.

The foundation supports the educational opportunities of disadvantaged children and young people impacted by poverty, neglect, abuse, and exploitation globally. The charity’s work spans the UK, the Caribbean, and Africa. Shai Foundation, through its sponsorship programme supported over 80 children in Haiti between 2012 -2021 to get an education and their families food parcels monthly. Shai foundation also built homes for the most vulnerable in the poverty-stricken island. The Foundation has extended its support to Barbados, where it funds the work of the Babbs Reading Clinic. The project teaches disadvantage boys and young men to read.

Jennifer lives in London and has one son, who, through her mentoring and example, was inspired to establish his own children’s care Home, providing accommodation and care for young men aged 16 and over. This continuation of service represents a tangible legacy of purpose in action.

Jennifer describes one of her proudest moments as witnessing her son carry on the work of developing young people, especially ‘troubled’ young men

The 25th Anniversary Celebration

The 25th anniversary celebration brought together past and present staff, family members, friends, and supporters, all united by their shared connection to Nailah House and its enduring values. The event was marked by reflection, gratitude, and celebration, honouring not only the longevity of the Home, but the people who have contributed to its success over the years.

The 25th anniversary celebration brought together past and present staff, family members, friends, and supporters, all united by their shared connection to Nailah House and its enduring values. The event was marked by reflection, gratitude, and celebration, honouring not only the longevity of the Home, but the people who have contributed to its success over the years.

The celebration recognised the loyalty, dedication, and resilience of staff, with shared memories highlighting the strong sense of family, community, and collective responsibility that defines Nailah House. It was a powerful reminder that the Home’s impact extends beyond buildings and policies, rooted instead in relationships, consistency, and care.

From its inception, the vision for Nailah House has been to provide a safe, nurturing environment where young people feel protected, respected, and supported to grow into independence. Jennifer firmly believes that “given the right environment, everyone has the capacity to achieve positive change.”

As Nailah House celebrates this remarkable milestone, it looks to the future with renewed purpose—continuing to uphold its founding values while adapting to the evolving needs of young people. The Home remains committed to delivering care that is compassionate, structured, and purposeful, ensuring that every young person is supported to move forward with dignity, confidence, and hope.

Jennifer Lapompe

January 2026

A Party at War With Its Own Past, and Unprepared for the Future

Submitted on: January 9, 2026

Submitted by: anderson connell

A Party at War With Its Own Past, and Unprepared for the Future

By David L Dec. Bowen JP

The Barbados Labour Party’s growing internal confusion has now been compounded by an even more damaging reality: a party unable to reconcile its present political needs with its own recent history.

The controversy surrounding St. Michael Central and the handling of Tyra Trotman did not arise in a vacuum. It reopened wounds the BLP itself created three years ago, when a devastating video, widely circulated and never meaningfully repudiated by the party at the time, cast serious doubt on political judgement, standards, and internal vetting. That video did real political damage. It shaped public perception. And it was never properly closed.

Fast forward to today, and the country is asked to believe that the same episode is now irrelevant, misunderstood, or unfairly recalled. The hurried apology and explanation offered by Tyra Trotman, clearly defensive, carefully worded, and politically necessary, only deepened the contradiction. Barbadians are left asking an obvious question: if the matter required apology now, why was it acceptable silence then?

This is not about personal redemption. It is about political consistency and credibility. A governing party cannot spend years benefiting from political attacks and character narratives, only to reverse itself when electoral convenience demands it. That is not leadership; it is opportunism.

The deeper issue is what this episode exposes about the Barbados Labour Party’s internal state. Candidate selection appears reactive rather than principled. Decisions are made, unmade, and then explained after the fact. Damage control replaces clarity. Apologies replace accountability. And once again, the public is expected to suspend memory for the sake of party strategy.

This is what political exhaustion looks like.

While the governing Barbados Labour Party struggles to manage its contradictions, the contrast with the Opposition could not be more stark. The Democratic Labour Party stands today as the only political party fully prepared for a general election, having named all 30 of its candidates, placed them before the electorate, and accepted the scrutiny that comes with readiness.

There are no surprise reversals. No emergency apologies. No last-minute narrative rewrites. The DLP has made its choices openly and early, because confidence allows transparency.

This election is shaping up to be more than a contest of policies. It is a test of political maturity. One party is facing the electorate with preparation and coherence. The other is still arguing with its own shadow.

And in politics, when a party loses control of its narrative, it rarely retains control of government.

David L. Dec. Bowen JP

January 2026

SHEDDING THE CARTEL

Submitted on: January 7, 2026

Submitted by: anderson connell

SHEDDING THE CARTEL: A THORNE IN THE SIDE OF EVIL.

By Wade Gibbons

I have lived in Barbados, consciously, under the previous rule of Errol Barrow, Tom Adams, Bernard St. John, Erskine Sandiford, Owen Arthur, David Thompson and Freundel Stuart. This is the first time I feel as though Barbados is under the yoke of an unsavoury cartel.

There seems to be no respect for our institutions and the rule of law, functioning democracy has become a mere catchphrase, there are suspicions about the operations of the judiciary and possible political influence, there is concern about the emasculation of the Barbados Police Service and obvious political interference and infiltration.

There is worry that many in the church pray to one God but kowtow to the whims and fancies of a would-be demigod. Barbadian values in grooming that made schoolchildren look like schoolchildren have been subsumed in the imported poison foisted on every parish in the name of education. Connected criminals are being gifted more resources than pensioners, children and the infirm. Drug abuse has moved from backstreets and indoors and now proudly parades at most social gatherings.

Traditional media have so taken to Bush Hill that some owners and managers would make Jezebel look chaste. The labour movement too is now showing similar flesh outside the Savannah. Both have been prey to Amazonian dictates. Political leaders are openly consorting, cavorting and carousing with thugs. Laws are being changed, not to serve the interests of the masses, but can be interpreted as providing opportunities for family and friends, and to extract money from beleaguered citizens.

Fear of the government has so gripped many Barbadians that they remain silent when they should be screaming to the high heavens. Their silence is a sharp contrast to the wounds our government inflicts daily.

Adults confuse rotund one-liners, rhetoric, quips and empty verbose for intelligence, negro influencers return to auction and sell their soul and integrity for a pittance. Some give attribution to the term "cares" as though it is a true moniker of its target's character, when it is nothing more than wasted air from the mouths of dullards.

Barbados seems just 30 pieces of silver away from its final descent - the first sanctioned killing of public dissenters by the criminal alliances of those pulling the strings.

The alternative for Barbados is abundantly clear.

As if living a paradox, one man with nothing to lose, has put everything on the line to lose, because he believes what he is fighting for is much bigger than himself. He sees the people he seeks to serve as greater than himself. He has no qualms about confronting "Big Works"; he intends to be a thorn in the side of evil.

The catchy, plagiarised slogan "lost decade" was used to good effect by a motley group. That misnomer has been replaced by the stark reality of Eight Years of Evil; eight years of murders and mayhem, eight years of contempt and corruption, eight years of bogus growth, botched laws and blind borrowing, eight years of worsening social services and contrived foreign reserves. Eight years of selling Barbadians an illusion.

The chance and choices to return Barbados to some semblance of decency and normalcy seem palpably easy. Time for Bajans to shed their blinkers. . .and the cartel

Author, Wade Gibbons,

January 2026

The Rt Excellent Errol Walton Barrow’s Mirror Image in the Eyes of Ricardo Eversley

Submitted on: December 4, 2025

Submitted by: anderson connell

I recently had the privilege of receiving some wonderful and inspiring news about one of our accomplished young black men, Mr Ricardo Eversley, a British born Barbadian offspring. With his consent, I am pleased to share this news, which highlight his remarkable achievements.

I recently had the privilege of receiving some wonderful and inspiring news about one of our accomplished young black men, Mr Ricardo Eversley, a British born Barbadian offspring. With his consent, I am pleased to share this news, which highlight his remarkable achievements.

Ricardo Eversley is the son of Mrs Judy Eversley and the late Dr Owen Oswald Eversley, OBE, who served as a former Deputy High Commissioner for Barbados to the UK. Currently based in London, Ricardo is a creative professional and holds the position of Senior Lecturer at the London Metropolitan University in the School of Art, Architecture and Design.

His broad knowledge of past, present and future trends is reflected in a diverse mix of consultancy, teaching, and creative practice-based solutions. These solutions are featured across the niches of digital products, branding, entertainment, fashion, and youth culture. At present, his research focuses on diversity in learning, the impact and significance of e-learning methodologies, contemporary digital products such as websites and apps, and the interplay of image and type, data, and visualisation.

Ricardo continues to advance his learning and contribute to academia, and he recently graduated with an MA in Learning and Teaching in Higher Education, which he received alongside students he teaches within The School of Art, Architecture and Design and three other schools at London Metropolitan University, Winter Graduation.. Ricardo was invited to deliver the opening address at the graduation ceremony at London Metropolitan University. He chose to frame his speech around the esteemed late leader of Barbados, The Rt Excellent Errol Walton Barrow, and his concept of the “Mirror Image.” In his address, Ricardo emphasised that graduation is not merely an event, but a privilege earned through sustained engagement.

In his speech, Ricardo spoke of achievements and reflected on The Rt Errol Barrow, the first Prime Minister of Barbados, whose visionary stance on education and self-determination included the idea of the mirror image we hold of ourselves. Ricardo then posed a thought-provoking question to the graduates: “What kind of reflection do you carry with you today?”

Ricardo’s presentation can be viewed here.

The Caribbean Daily Eye extends its congratulations and best wishes to Mr Ricardo Eversley for his accomplishments and contributions to the world of education.

Anderson Connell

Sources: London Metropolitan University, Mr Ricardo Eversley, Mrs Judy Eversley.

03 Nov 2025

We’re In The Mist of A Global Conflict Involving The Caribbean.

Submitted on: October 24, 2025

Submitted by: anderson connell

US Conflict In The Caribbean, An Aspiring Global Reach.

We're in the midst of a global conflict that's going to engage the Caribbean region; WW3 if you will. Venezuela/Caribbean Sea is just another front of the war between Anglo-America and its allies and Russia and its allies which includes Venezuela and Cuba.

The US is about to fight 3 wars on 3 major fronts. The Caribbean. (Its backyard which will also result in domestic conflict on the US mainland in time). Europe/Ukraine (This war will spread into Western Europe by next year), Gaza/Iran/Middle East bearing in mind the primary target is China.

Within the Caribbean region, we have Trinidad & Tobago's (TT) new PM who has shown no interest in the collective agreement with, nor the development of CARICOM, and who is in full support of the US. The TT PM is fully in support of the US’s unilateral military actions in the Caribbean region against the cover of drug cartels but with the goal of regime change in Venezuela.

There is no international agreement or approval for the US’s current military actions in the Caribbean region, but then they (President Donald Trump) appear to be using the precedence set by Russia (Vladimir Putin) against Ukraine. In fact, many international bodies / leaders are calling this action by the US in the Caribbean region, illegal.

As for the rest of CARICOM members, they are at a loss and have been for many years. Some were relying on Barbados PM, Mia Mottley to enable CARIOM to deliver the collective power and strength of the region as an international force, but sadly, Motley has her career designs on the UN from what we can see. She’s an establishment lackey anyway and is effectively a colonial governor for the crown. So, for all intense purposes, CARICOM and by extension, the Caribbean region, bears no relevance to the US, neither do they have any clout to influence the US away from its current military actions in the region, and its ultimate goal of regime change in Venezuela.

In addition, there’s not going to be any leaders in the Caribbean who will put their lives and careers on the line for this. Geopolitically this is way over their heads, and the Caribbean is not a zone of influence nor does it have any political leverage internationally. The US is aware of this, and Venezuela is the easiest of the Ukraine Iran China/Russian targets. It wouldn’t be a surprise if President Maduro of Venezuela does a runner and allows Venezuela to collapse to save himself as apparently his been attempting to make backdoor deals with the US.

The US’s ultimate goal is regime change in Venezuela, which will give the US full access to the rich oil reserves in the Caribbean region, which includes, Venezuela, Trinidad & Tobago, Guyana and Suriname.

The US through Trump, is also in a hurry to get ahead of China, mobilizing in Taiwan, and while Russia is occupied with Ukraine.

Every single empire in history has collapsed. It’s a 100% failure rate, Anglo-America is no different. And as is the case with all empires when in their final collapse phase, they pursue war which is also usually preceded by economic collapse.

We’re in a pivotal time of history. An interregnum if you will. The important question many are asking is what comes next as Anglo-America will collapse....

Discussion thoughts, Anderson & Shawn

Not All Of Us Are Sleeping.

Submitted on: October 14, 2025

Submitted by: anderson connell

Not All Of Us Are Sleeping!

The Freedom of Movement Bill — A Dangerous Shortcut to Undermining Democracy While it is not unusual for legislation to be passed with retroactive effect, the recent handling of the Freedom of Movement Bill raises serious questions about the haste, secrecy, and special treatment surrounding this particular piece of legislation.

Leader of the Opposition, the Honourable Ralph Thorne, K.C., in responding to the lead presentation by Minister of Home Affairs, Wilfred Abrahams, challenged the government to explain its undue rush and to show the people of Barbados the respect they are owed when it comes to matters as sacred as citizenship and sovereignty.

In August 2025, Prime Minister Mia Amor Mottley announced that, effective October 1st, citizens of Dominica, Belize, and St. Vincent and the Grenadines would be allowed to move freely in and out of Barbados. Following legitimate legal and constitutional concerns raised by the Opposition Democratic Labour Party, the Prime Minister later declared in a public broadcast that these citizens would be entitled to the same rights as Barbadians—to work, to access health care, and to receive education in Barbados.

This announcement was not preceded by any consultation with the Social Partnership, far less with the general public. Yet, on October 13th, the government brought the Bill before Parliament, and on October 1st, even before debate had begun, the Prime Minister’s directive was already being enforced. Citizens from the named countries were granted indefinite stay, instructed to register with the Electoral and Boundaries Commission and the National Insurance Department, and were treated as de facto residents—all without the passage of law. The Minister’s directive to the Chief Immigration Officer—a public servant bound by ministerial instruction—effectively bypassed Parliament and the Constitution. This is not governance; this is rule by decree. Barbadians have grown weary of this government’s practice of making far-reaching policy decisions without debate, without transparency, and without consent. With an overwhelming parliamentary majority, the Mottley administration behaves as though it is accountable to no one. The result is a pattern of arrogant unilateralism—a government that commits the country to binding actions and treaties without public scrutiny or democratic participation.

To this day, Barbados functions as a republic without a republican constitution—a constitutional vacuum that has allowed the government to operate as an elected dictatorship. Parliament, the guardian of our freedoms, has been reduced to a stage-managed performance—a rubber stamp for the Prime Minister’s will. Parliament, as John Diefenbaker reminds us, “is the custodian of the people’s freedom.” It is also, as Ziauddin Sardar wrote, “the supreme decision-making and legislative body of any democracy.” Yet under this administration, Parliament no longer reflects the collective desires of the people—it reflects the private ambitions of one person. While most Barbadians remain supportive of regional integration, they are rightly alarmed at the contemptuous and autocratic style that now defines governance in this country. This pattern fits what political scholars call “salami tactics”—the slow slicing away of democratic freedoms, each cut appearing small and harmless, but collectively resulting in the silent erosion of democracy itself. As described in The Dictator’s Playbook (2023), this incremental dismantling of norms makes democratic backsliding especially insidious, for it uses the very institutions of democracy to destroy democracy. Barbadians owe Ralph Thorne a profound debt of gratitude for his legal scholarship, moral courage, and patriotic conviction. His decision to break from the Barbados Labour Party and to stand as Leader of the Opposition was not one of convenience, but of conscience. He has chosen to defend the rule of law, the integrity of Parliament, and the rights of Barbadian citizens—values that once defined our political culture but are now under siege.

We ignored the warnings of former Prime Minister Owen Arthur, who cautioned this nation about the dangers of one-person rule. Today, we see the consequences of that neglect. Barbados stands at a crossroads—between constitutional democracy and creeping authoritarianism.

Dr. Derek Alleyne

October 14, 2025

Key Questions On The Sugar Industry.

Submitted on: July 8, 2025

Submitted by: anderson connell

The 2025 sugar harvest ended on June 4, and the authorities have not provided any public information on the performance of the industry. A published article on June 7th reported that the Minister of Agriculture Indar Weir said it was too early for him to comment (on the 2025 crop season).

Given the numerous challenges facing the sugar industry, it is opportune for the Mottley administration to provide answers to the following questions for the benefit of the public. The questions relate to production, technical, marketing, financial, and worker welfare issues.

The totality of responses to the various questions will give industry stakeholders and the wider public a clear understanding of the state of the sugar industry and its likely future.

- What is the quantity of canes harvested during the 2025 crop season? What are the comparative figures for the previous three years?

- What is the quantity of sugar and molasses produced during the 2025 crop season? What are the comparative figures for the previous three years?

- Has Portvale factory been subjected to the minimum international benchmark assessment for the operation of manufacturing plants during the last three years, for example, Hazard Analysis Critical Control Point (HACCP) and/or any other relevant International Organization for Standardization (ISO) assessment?

- Are problems being experienced in marketing and selling sugar in export markets? If the answer is yes, outline the nature of the problems.

- Is there sugar unsold from the 2024 crop? If the answer is yes, what is the quantity and its value?

- Is there sugar unsold from the 2025 crop? If the answer is yes, what is the quantity and its value?

- Where are the storage facilities for the sugar?

- What is the value of Government's subsidization of the sugar industry in 2024 and 2025, and the expected level in 2026?

- Has the impasse between the Barbados Sustainable Energy Cooperative Society Limited (CoopEnergy) and the Government been resolved?

- Is the Barbados Agricultural Management Company Limited (BAMC) still operational despite its announced closure on December 31, 2023?

- Is the Barbados Energy and Sugar Company Inc. (BESCO), the CoopEnergy-owned company, in charge of the operation at Portvale factory or BAMC?

- Have the publicly voiced concerns (related to deteriorating factory equipment, unresolved labour disputes, and lack of clarity regarding ownership shares) of the workers been dealt with to the satisfaction of the workers and their representatives?

- What is the status of the pension fund for the former workers of BAMC?

- Is there a realistic future for the sugar industry? If the answer is yes, indicate the anticipated size, source(s) of funding, and management arrangement.

Written by Anthony P. Wood, Economist, and Minister of Agriculture and Rural Development in a previous Barbados Labour Party Administration

Another Call For The Mottley Administration To Reduce Its Appetite For Borrowing!

Submitted on: July 8, 2025

Submitted by: anderson connell

For the past four years, economist Professor Michael Howard and I have written consistently about the implications of the Mottley administration's excessive borrowing policy to support its runaway expenditure.

In a previous article in which I predicted that the administration would enter a second programme with the International Monetary Fund (IMF), I noted the administration was engaging in a type of Ponzi scheme in the management of the country's debt. Simply put, the administration was borrowing to help with the country's debt repayment obligations.

Despite the danger signs in the excessive borrowing policy and the publicly given advice to moderate the appetite for borrowing, the administration continued its 'escalating expenditure and heavy borrowing' policy during the second IMF supported Barbados Economic Recovery and Transformation (BERT) programme.

The proverbial chickens have come home to roost as the country exits the formal relationship with the IMF at the end of June and returns to the international capital market in search of urgently needed funds.

Recall that arising from the 2025-2026 Estimates, the public deficit was conservatively set at $1.15 billion. This figure increases when the net expenditure from this year’s Budget is considered and other policy and project specific loans are added. Also, following record debt servicing of $2.2 billion for the financial year 2024-2025, the projected debt service for the current financial year is $1.78 billion. Further, the projected stream of debt repayments for the financial years 2025-2026 through to 2029-2030 is $8.45 billion, an annual average of $1.69 billion.

These figures indicate that the country remains on a dangerous debt trajectory. Managing the debt situation is complicated by the following factors. First, the country's credit rating status remains speculative or junk. Second, the country is still categorized as highly indebted, with a debt to (nominal) gross domestic product ratio in excess of 100 per cent which is the highest in the Caribbean. Third, the unwillingness of the administration to rein in expenditure and, hence, reduce the need for such excessive borrowing.

The first two factors will result in unavoidable borrowing by the administration attracting reasonably high interest rates as creditors in the international capital market move to protect themselves against the riskiness of lending to Barbados.

It is, therefore, an idle boast by the Prime Minister that the country garnered bids five times over what was being asked when three times the requested amount was considered successful. The real issue is not the amount financiers are willing to lend but, more importantly, the cost of the funds in the current precarious debt situation of the country.

The admission by the administration finally of the use of what amounts to a Ponzi scheme in its debt management strategy is not surprising to economists and others following issues related to the public debt.

There was a steep increase in borrowing during the BERT programmes. Borrowing increased from $427.96 million in the financial year 2018/2019 to $1.64 billion in 2024/2025. The figure is expected to increase further during the current financial year. It is informative to note that the increase in borrowing continued unabated during the post-pandemic period when gross domestic product and taxation revenue reached record levels.

The massive increase in borrowing was matched by similar increases in debt service obligations. Debt repayments between the financial years 2018-2019 and 2024-2025 increased from $484 million to a staggering $2.2 billion.

The harsh reality is that the administration has boxed the country in a corner through its economic management policies during the BERT programmes. It is atypical for a small developing economy to escalate expenditure and engage in excessive borrowing during IMF economic adjustment programmes which normally have a stabilization focus.

The policies of the administration have left the country heavily reliant on borrowing despite its continued speculative or junk credit rating and highly indebted status.

The recent issue of the US$500 million (BDS$1 billion) bond in the international market along with the initiative to raise $300 million on the local market ($200 million through Barbados Optional Saving Scheme (BOSS) bonds and $100 million through a US dollar denominated bond targeted at Barbadians with foreign currency bank accounts) are the front-loaded borrowing amounts during the current financial year. Given the size of the hole in the public finances and the need to secure funds for specific projects, there will be more borrowing during the financial year.

An interesting feature of the bonds for the local and foreign capital markets is the marked difference in their cost. While the debt issued in the international market is at 8 per cent, the locally issued bonds are at 4.5 per cent and 3 per cent, respectively. The simple question that emerges is why are the foreign investors demanding more than the local investors.

Alternatively, why does the administration have less negotiating strength when dealing with investors in the international market? The rational answer is the urgency in attracting the funds, and the speculative or junk credit rating and highly indebted status of the country render the negotiating position of the administration in the international market fairly weak.

Other reasons for the differential interest rates with the local and foreign bonds are the limited investment opportunities within the economy for domestic savings and the negligible interest rate paid on funds held in the local financial system.

The admission that the 8 per cent US$500 million bond issue will be used to retire lesser cost debt and make a $142 million debt payment to the IMF should be of grave concern to Barbadians. Such an approach to debt management in the name of liability management and smoothing debt payments is unsustainable and keeps the country immersed in a debt trap. Such a policy is indicative of a failed debt management strategy and should be discontinued as soon as practicable.

Written by Anthony P. Wood, Economist, and former Lecturer in Economics, Banking and Finance at the Cave Hill Campus of the University of the West Indies. He was also a Cabinet Minister in a previous Barbados Labour Party Administration.

Cllr Diana Collymore is Skydiving for Justice!

Submitted on: June 30, 2025

Submitted by: anderson connell